CHRIST University offers rigorous programs, valuable resources, and countless opportunities that will enable you to pursue your desired course of study..

The programmes offer deep insight into the built environment through ecological, social, artistic, and technological lenses.

Explore

The School of Commerce, Finance and Accountancy is dedicated to fostering academic excellence and holistic development

Explore

The School of Education offers quality teacher education with a focus on research and social responsibility.

Explore

Offers a wide range of programmes approved by the University Grants Commission (UGC) and All India Council for Technical Education

Explore

The school explores inquiry beyond words through history, philosophy, critical and cultural studies.

Explore

School of Law, Christ University offers quality legal education with a focus on ethics, justice, and practical training.

Explore

The programs foster scientific insight, ethical awareness, and skills for practice, research, and critical thinking.

Explore

Offers UG to post-doctoral programs in Chemistry, Physics, Math, Life Sciences, and Computing Explore

Dedicated to interdisciplinary learning, engaging students and faculty in a variety of cross-disciplinary experiences and programs

... Explore

Dr Leena James, School of Business Management and Head of the SDG Cell, has been conferred with the prestigious Women Change Maker of the Year Award at the New Age Summit - Business and Education Conference.

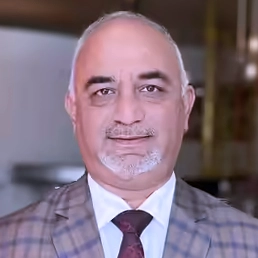

Dr. Fr Joseph C C, Vice Chancellor

Distinguished Service Award during the 55th Annual Family Day 2025 - “A Day to Reunite, Reflect, and Reignite”

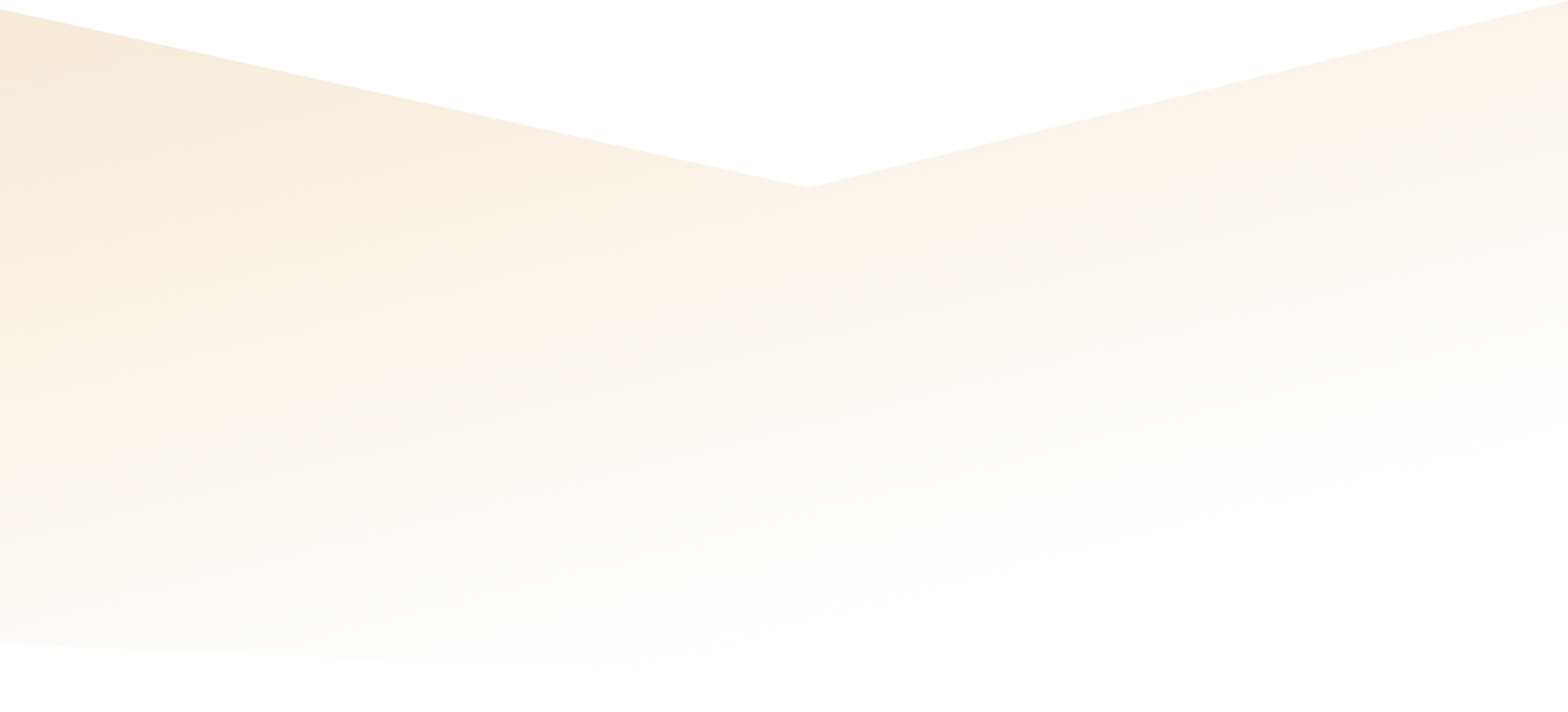

Conferral of the French Decoration, the "Ordre des Palmes Académiques" (Order of Academic Palms) to Dr Mallika Krishnaswami by Consul General of France Marc Lamy, Bangalore.

The Karnataka Swimming Association proudly congratulates Aneesh S Gowda on receiving the prestigious KOA Award for the year 2023 | Felicitated with SSI KARNA Award by Sports Science India in Kalinga stadium by Shri Kanak Vardhan Singh, Deputy Chief Minister of Odisha.

Gunjan Mantri (I BA) was selected to represent INDIA in the Under-18 Women’s National Basketball.

Team in Dubai from 11th to 18th November 2024.

Ms.Sarah Lourdes Pais and Ms.Bishalta Pradhan from 6 EMS have bagged "British Council 70th Anniversary Scholarship" worth $10,620 to pursue Master's Degree in Data Science at Liverpool Hope University.

RIDDHI S BOHRA of II BBA won a silver medal in the 50M BREASTSTROKE & bronze medal in the 100 breaststrokes the 1st KHELO INDIA UNIVERSITY GAMES held at KIT- Bhuvaneshwar, ODISHA

Christ University Wins Excellence in Tech-Enhanced Training and Placement Award at TechEDU India Awards 2025.

CHRIST (Deemed to be University) Awarded ‘Outstanding Private Deemed to be University’ at The Economic Times Education Excellence Awards 2025

CHRIST University's NCC bags the prestigious "Best Institution Award" from the Karnataka and Goa Directorate for the year 2024-25

Students receiving Deputy Director General's Commendation from Air Cmde SB Arun Kumar VSM, Deputy Director General, NCC Karnataka & Goa Directorate

Physical Sciences: Christ University is ranked between 601 and 800 globally

Physical Sciences is a group of subjects such as mathematics and statistics, physics and astronomy, chemistry, geology, environmental sciences, and earth-marine sciences.

The University welcomes students from all over the world to a vibrant environment of religious and racial harmony, secularism and cultural diversity Know more

Christ University hosts distinguished guests from academia, industry, and the arts, inspiring students and faculty through insightful interactions and discussions.

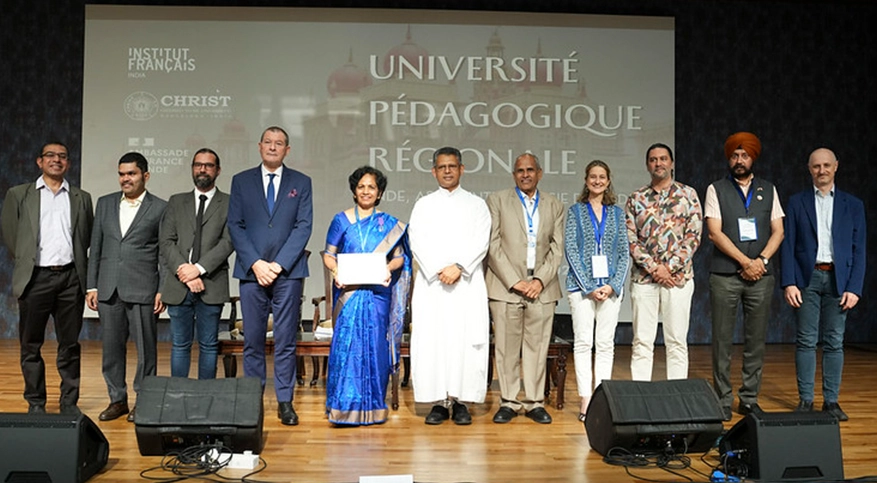

Padma Bhushan | Padma Vibhushan | Bharat Ratna

Former President of India | Indian Aerospace Scientist

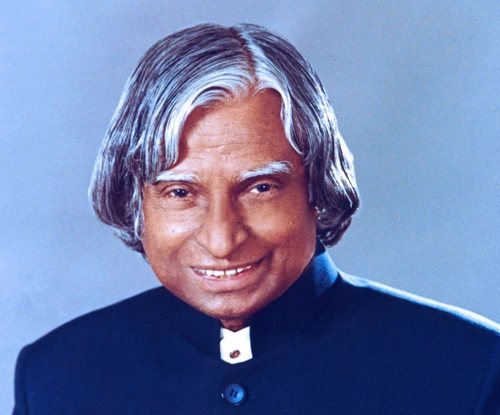

Bharat Ratna | Padma Vibhushan

Former President of India

Awarded the Nobel Peace Prize

Spiritual Leader of Tibetan Buddhism

Padma Vibhushan | Indira Gandhi Paryavaran Puraskar

Indian Spiritual Guru and Founder of the Isha Foundation

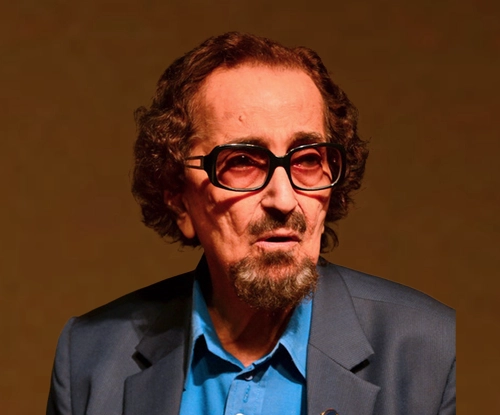

Padma Shri

Indian Filmmaker

Padma Bhushan | Padma Vibhushan

Indian Space scientist | Former Chairman, Indian Space Research Organisation

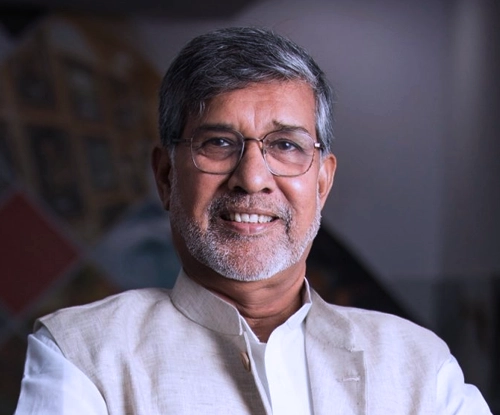

Nobel Peace Laureate

Indian Social Reformer

Conferred with Padma Shri

Indian Theatre Personality and Ad Film Maker

Awarded the Padma Bhushan

Indian Educator, Author, and Philanthropist | Former Chairperson, Infosys Foundation

There are multiple labs affiliated to Schools on each campus of CHRIST. There are science labs, computer labs, engineering labs, language labs, performances studios, Media labs, incubation and innovation Centres to fortify the research culture.

Industrialist

Bachelor of Commerce (BCom)

1972

Indian Police Service

PCMB (Christ College) 1996

Chairman & CEO

Tharanco Group

Bachelor of Commerce (BCom - 1982)

IAS

Indian Administrative Service

BSc CME (2006)

Executive Director

EY

Bachelor of Commerce (BCom - 2005)

Legal Officer

Organisation for the Prohibition of Chemical Weapons (OPCW)

The Hague

School of Law

Indian Actor

Film Industry

BA Communication and Media, English and Psychology (CEP - 2012)

Lawyer

Bradley Allen Love Lawyers, Canberra, Australia

School of Law

Co-founder

Kompany Hospitality & Soka

Bachelor of Hotel Management (2004-08)

SVP and Managing Director (India)

Blume Global

Bachelor of Commerce (BCom - 1989)

Managing Director

Canadian International School Bangalore

Bachelor of Business Management (BBM - (2004)

Indian Actress

Tamil/Malayalam

Bachelor of Commerce Tourism (2013)

Musician

Director, Taaqademy

BA JPEnglish (1998)

Managing Director

Shand Group of Industries

Bachelor of Commerce (BCom - 1989)

Co-Founder & CMO,

Camcom

Bachelor of Hotel Management (1992 - 95)

Chairman and Managing Director

White Group

BSc PCM (1987)

Politician

MLA, Byatarayanapura Constituency, Bangalore

Bachelor of Business Management (BBM - 1994)

Professor & Principal

Apeejay Institute of Hospitality, Navi Mumbai

Bachelor of Hotel Management (1991 - 94)

Indian Actress / Producer (Kannada)

Film Industry

Bachelor of Business Management (BBM)

(2009)

Indian Actress / Model (Kannada)

Film Industry

BA Communication and Media, English and Psychology (CEP - 2012)

Senior Vice President

Masai School

Bachelor of Business Management (BBM - 1995)

Vice President

JP Morgan

Master in Business Administration (MBA - 2008)

Executive Editor - News

Republic TV

BA JPEnglish (2007)

Business Editor

Deccan Herald

BA JPEnglish (2006)

Restauranteur

Director, Empire Group of Restaurants

Bachelor of Hotel Management (BHM - 2014)

KAS

Karnataka Administratice Service (KAS)

Bachelor of Commerce (BCom - 2016)

Indian Actor

Film Industry

Bachelor of Business Management (BBM - 1997)

Partner

P N RAO FINE SUITS

Bachelor of Business Management (BBM - 2001)

Advocate, Supreme Court of India

Legal Consultant, Ministry of External Affairs

Bachelor of Commerce (BCom - 2007)

Exective Chef

Taj Hotels Resorts and Palaces

Bachelor of Hotel Management (BHM - 1999)

Politician and Lawyer

National Vice President, Bharatiya Janata Yuva Morcha

BA LLB (2011)

Politician

Member of Legislative Assembly Mandar Constituency

Bachelor of Business Administrtaion (BBA - 2010)

Film Director

Documentary Maker and Theater Person

BA Communication and Media, English and Psychology (CEP - 1994)

IAS

Indian Administrative Service

Master of Business Administration (MBA - 2009)

Senior Vice President

Bank of America

Master of Computer Applications (MCA - 2000)

Vice President

Goldman Sachs

BCom (2011)

IAS

Indian Administrative Service (IAS)

PGDM

Indian Politician

Member of Parliament, Kottayam | Former, Loksabha MP, Idukki

Indian Police Service (IPS)

Former Commissioner of Police

Bangalore City

IPS

Indian Police Service (IPS)

BCom

President

The Narayana Group

BCom

Playback Singer

South Indian Films

BSc CMS (2006)

Maharani of Mysore

Wife of Yaduveer Krishnadatta Chamaraja Wadiyar, 27th Maharaja (King) of Mysore

MA Economics

Radio Jockey

94.3 Radio One

BA CEP (2014)

Senior Vice President

JP Morgan Chase & Co

(2001)

IPS

Indian Police Service (IPS)

MBA (2006)

Second in Command

Central Reserve Police Force

Chennai

BA HEP (1999)

CEO, Vee Technologies

Vice Chairman, Sona Group of Instituions

BCom (1988)

Executive Chef

Sheraton Grand Bangalore

BHM

Executive Director

Cadabams Group

BA (Psychology, Communicative English, Literature)

MSc Clinical Psychology (2005 - 2010)

Managing Director

Cleanslate Communications, London - United Kingdom

BBM (1994-1997)

Director

Marketing at Hitachi Vantara, India & SAARC

School of Business and Management, MBA, Marketing (1996)

| NURTURING EXCELLENCE

| ENRICHING LIVES

| TRANSFORMING FUTURE

Socialize

with wide Numbers